Akropolis' mission is to give people the tools to save, grow and provision for the future safely and without dependence on geography, a central counterparty, or falling prey to the predatory financial practices of multiple intermediaries.

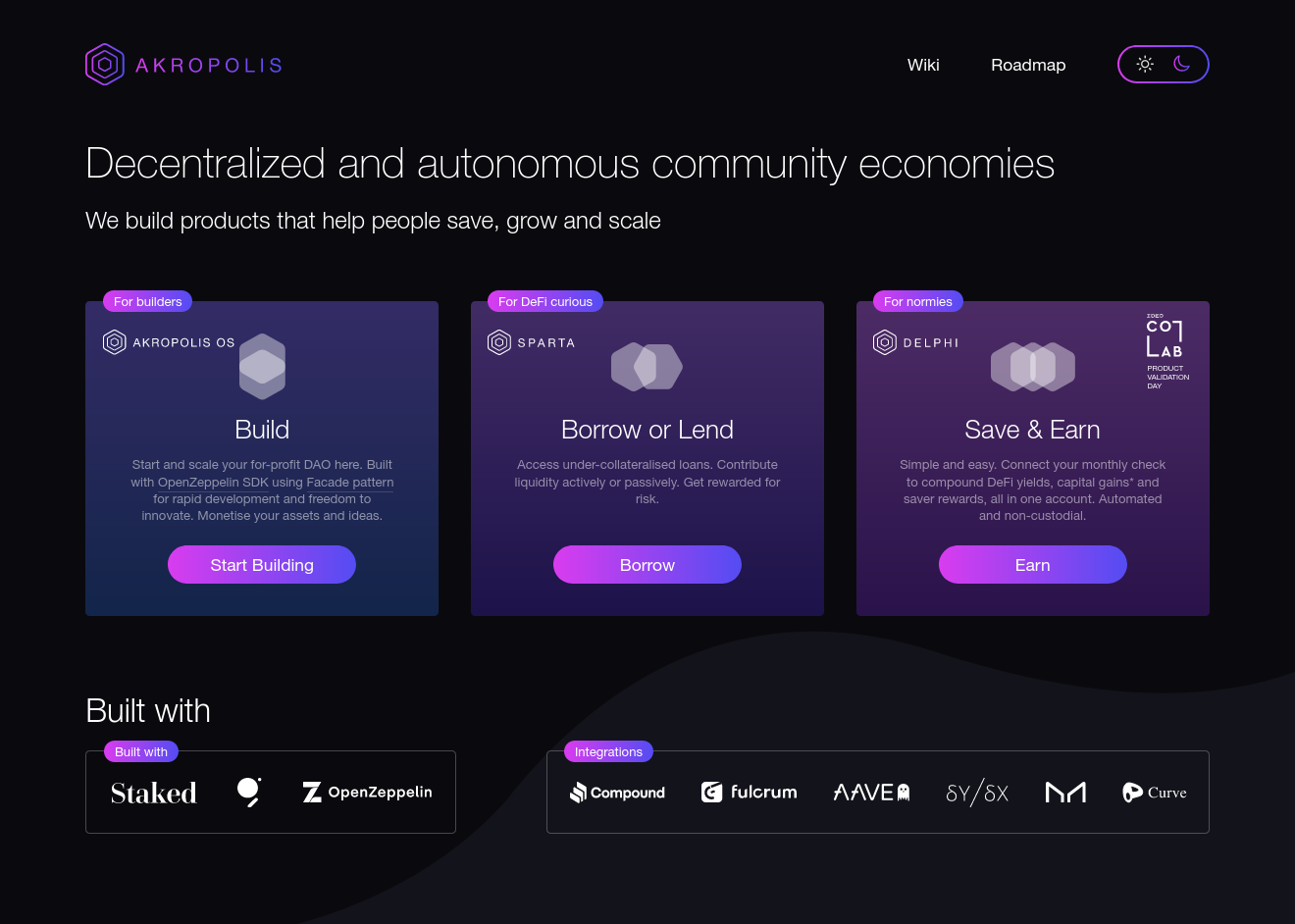

With that in mind, Akropolis has built AkropolisOS, a light and modular framework for creating for-profit DAOs, with customisable user incentives, automated liquidity provisions enabled by a bonding curve mechanism, and programmatic liquidity and treasury management.

Their first product, Sparta, allows taking undercollateralized loans (borrower provides only 50% of collateral), as well as passively generating yield via integrated yield rebalancer to get maximum available APR from different DeFi protocols. All funds are pooled, and the internal economy is based on a bonding curve, providing additional incentives to the users.

Another product they’re developing is Delphi, a pool which allows executing automatic dollar-cost averaging into BTC & ETH (thus diversifying long-term investment portfolios) and participating in different yield harvesting (liquidity mining) possibilities.

Head here to learn more about Akropolis’ products.

Challenges

For the Akropolis team, setting up and maintaining their own nodes was neither cost-effective nor feasible given the size of their team and their timelines for product development. Powering their products would require a dedicated DevOps specialist and an ongoing investment in time and money to maintain the infrastructure itself. For example, when they launched Delphi, there were significant surges in request volume (over 2 million requests) and huge loads for several hours. Without a trusted and proven infrastructure service provider, it would have been incredibly difficult for their team to stabilize, monitor, and keep up with surges in usage on the Delphi platform.

Proven and Reliable Infrastructure to Withstand Surges in Request Volume

The Akropolis team decided to source their infrastructure needs for their applications, Sparta and Delphi, to Infura. By offering simplified integration and the ability to confidently handle high request volumes, Infura helped Akropolis service surges in consumer demand across their product suite with ease.

“We found Infura after researching different infrastructure solutions. It was a no-brainer to use an existing proven and reliable infrastructure provider rather than reinventing the wheel and building our own, so that’s why we chose Infura. Our custom Infura plan is saving us around $5k a month on DevOps salaries and servers, not to mention countless engineering hours saved. Now, despite some overlays, our product has been able to comfortably withstand surges in volume and daily load (approx. 300,000 requests on average), thanks to Infura.”

-Yana Marakhonova, Community Lead, Akropolis

Akropolis uses Infura’s Ethereum APIs on the frontend to catch calls, update UIs, receive on-chain data, and to broadcast transactions. They also use Infura’s archive node service to access historical snapshot data in order to distribute rewards to liquidity providers in decentralized exchange (DEX) pools. Overall, Infura enables Akropolis to supply accurate and consistent blockchain data, improve the reliability and performance of their applications, all while accelerating core product development.

See how our other customers use Infura to handle their infrastructure needs.